Freight Market Update: June 2024

Updated June 20, 2024

Customize and download this report

Top story: Summer Seasonality Impacting Freight

It’s summer! Time for family vacations, grilling on the patio, going to the beach or lake—and hurricanes! Like most seasons, summer has known surges and disruptions that temporarily impact freight markets. While cyclicality in the larger marketplace is driven by the market seeking balance between freight demand and carrier supply, seasonality is driven by recurring situations that repeat each calendar year and temporarily increase demand and/or decrease supply. Seasonality can and should be expected, which means plans can be created to limit the impact to service and pricing. Before everyone's minds shift into summer mode, our top story below will review the most common summer seasonal disruptions for transportation, specifically hurricane season, 4th of July, and Labor Day.

In our April report, we highlighted seasonal factors occurring in May that impact the transportation market. We continue our focus on seasonality by reviewing the effect of typical summer disruptions and events of hurricane season, 4th of July and Labor Day.

According to the National Oceanic and Atmosphere Administration (NOAA), the official hurricane season for the Atlantic basin is June 1 - November 30, with peak activity between August and October. In 2024, NOAA is anticipating above-normal hurricane activity, with a forecast of 17-25 named storms. As of June 19, NOAA forecasters were watching two disturbances, one of which is Tropical Storm Alberto and is impacting the Laredo/Matamoras/Monterrey area. C.H. Robinson's account teams are monitoring for any impacted customers. But an above-average hurricane season does not always mean that there is an impact to the United States or the transportation market. While the 2023 hurricane season was the 4th most active season on record, only three storms hit the United States, affecting South Texas, Florida, Georgia, and the mid-Atlantic states (see below). The impact of a storm on populations, economy, and freight markets is driven by the size of the storm, where it strikes the coast, and how far inland it extends. A large storm hitting a rural area with no large metropolitan areas in its path will not have the same effect also those whose path goes through densely populated regions. Additionally, some continue their path of destruction in the form of tornadoes and flooding for hundreds of miles inland, while others lose strength quickly once making landfall.

2023 Hurricane Season Map. Source: Public Domain accessed through Wikipedia: WikiProject Tropical cyclones/tracks, developed by Jasper Deng using data and images from NASA and the National Hurricane Center's hurricane database

Specific to transportation markets, there are three phases of a storm that affect freight: before, during, and after the storm.

Before the storm: People and freight rush out of the area and carriers avoid moving standard freight inbound as they avoid the risky area. Shippers try to clear the docks and forward position shipments as much as possible, while trucks and vessels look for opportunities to get out of the storm's path. This leads to a temporary tightening of that regional market, typically leading to a quick increase in rates. Ocean cargo is diverted to other ports, which can cause temporary port congestion.

During the storm: The focus is safety, so people and freight movements are very limited, restricted to safety and relief focused efforts. Typically, government agencies influence when people and freight can begin to move again.

After the storm: This phase is highly impacted by the damage caused by the storm and the economic criticality of that area. Freight movement occurs in phases, with van and reefer shipments beginning the initial rush, followed by flatbed trucks bringing in equipment and material to aid in reconstruction. Rates inbound to the affected area increase quickly due to the demand to bring in supplies and materials. Once shippers re-open, they will often have a backlog of orders to ship out, increasing outbound demand. This increased rate environment will often draw for-hire carriers to the region, causing truck availability in other regions of the country to decrease. For ocean and rail shipments, diversions to other ports and terminals typically continue until the facility is re-opened for operations.

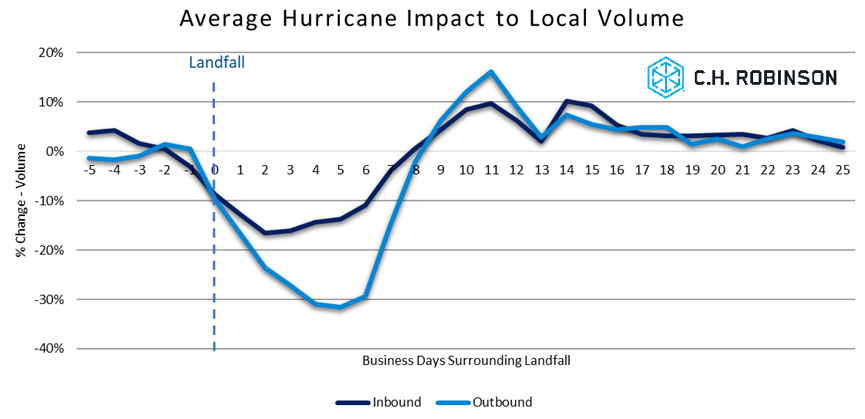

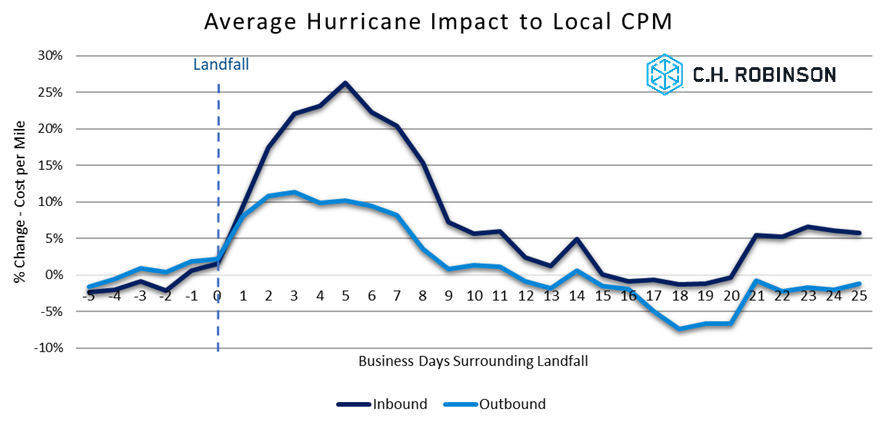

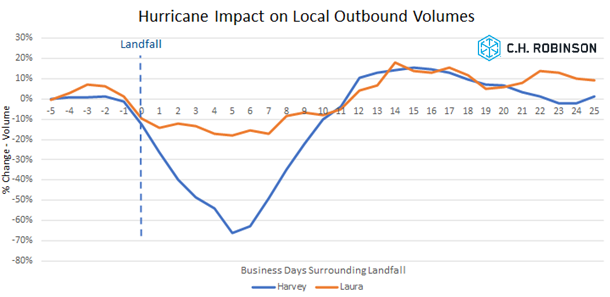

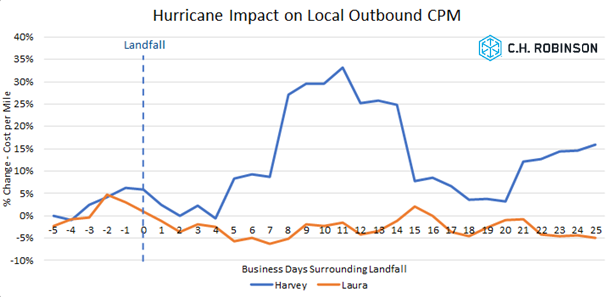

The following visuals depict these phases of over-the-road freight movement, showing the impact of cost per mile and volume for both outbound and inbound freight from 7 storms (Delta, Harvey, Ian, Ida, Irma, Laura, and Michael).

Hurricanes Harvey (2017) and Laura (2020) were both Category 4 storms that struck the Gulf Coast of the United States 3 years apart, with only 350 miles separating their landfall locations. While Harvey's path and rotation had a major impact on the metropolitan areas of South Texas, Laura's impact to major economic zones was less severe. Additionally, freight markets were somewhat similar in the summers of 2017 and 2020, with both years in recovering conditions coming out of a freight market lull. This example shows that even events with similar characteristics can impact freight markets in different ways, with a key consideration being the economic areas impacted by landfall and the path the storm takes.

4th of July and Labor Day are national holidays when many shippers and carriers stop operations to celebrate. Additionally, these are also holidays when many families in the US tend to start or finish family vacations, leading to a higher likelihood of market imbalance. During these holidays, you typically see shippers increasing demand in advance of the holiday, either to get orders out before closing or because their industry sees increased orders related to the holiday. At the same time, carriers want to be home for the holiday, so they are looking for freight in a home-bound corridor with plans to take a few days off, or they are willing to take a shipment around the holiday for a premium.

Our academic research with MIT's Center for Transportation and Logistics showed that the 4th of July holiday caused the most significant change in contract route-guide performance of both high and low-volume lanes. That research also showed that in a soft market (as we are in currently) low-volume lanes were much more susceptible to route guide degradation than high-volume lanes. Spot market shipments are always more susceptible to market tightness around holidays than contract freight, as shown in the figures below with more than 10-years of DAT data, where the market tightens the week before the holiday and dives well-below the expected value during the holiday, followed by a "catch-up" after the holiday.

If you have low-volume, infrequent contract or spot market freight, our recommendation is that you consider a specific procurement strategy for the holiday period to limit tender rejections and unplanned cost increases. Please contact your C.H. Robinson account team for support with developing such a strategy. And if you are curious what we anticipate the cost impact of holiday market tightness will be, reference our spot market forecast in the Truckload section of this report.

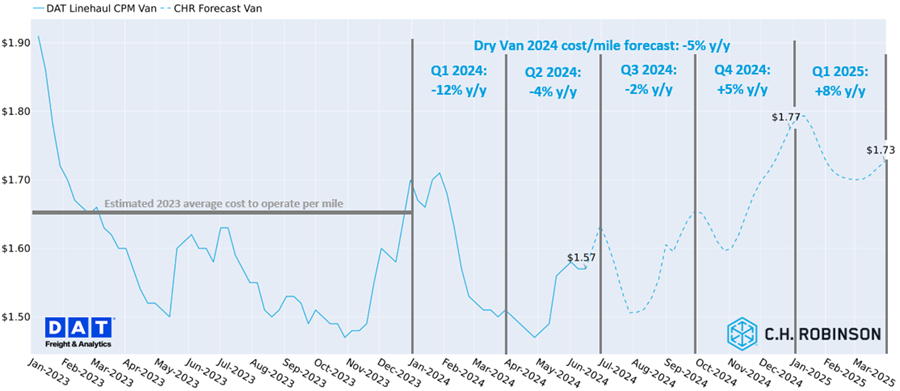

U.S. Spot Market Forecast

Our 2024 dry van linehaul cost forecast has been cut from -2% to -5% change y/y. Several underlying factors to both supply and demand influence our changes to the forecast. From a supply side, we continue to be in a drawn-out stage of oversupply. In our Robinson Report from October of last year, we discussed the two predominant root factors causing this:

Eight months later we look back and reflect on this today. Robust small carrier balance sheets allowed for many carriers to pay off their equipment loans, which account for a significant monthly overhead cost. With a now lowered cost structure, these carriers are now able to operate beneath the average breakeven cost/mile. There are still many challenges at operating on such thin margins, for example, a truck breakdown could put them beyond the point of recuperation. We are seeing carrier attrition occur from the small carriers this year, but just at a slow pace. And as we mentioned in last month’s report, produce season has allowed for a slowing of this attrition as regional demand is more abundant and at higher rates. The largest carriers tend to have more diversification within their business and are less reliant on the volatile spot market.

While we are seeing class-8 production/sales soften a bit, they still remain higher than expected. Large-sized (and many mid-sized) carriers are typically the ones that purchase new class-8 vehicles. These carriers are continuing to buy tractors despite the soft market, as both a way to increase driver retention and to keep fleets young. The decrease in fleet age not only helps reduce maintenance costs and decrease emissions, it also allows for a phased in approach whenever the EPA mandates go into effect in 2027. These purchases are helping to keep elevated amounts of trucks on the road and keeping supply at a high level, despite rather modest demand.

Produce season continues to put upward pressure on spot rates and will likely do so through the July 4th holiday. This varies regionally, but the points further south such as Southern Florida and U.S.-Mexico border crossings around Texas and New Mexico are starting to see some alleviation of rates from their peak. As peak produce season continues to push north, we are still seeing increased rates out of the mid-Southeast like Georgia and the Carolinas as well as the Southwest out of California and Arizona. Overall, we expect that the nationwide cost/mile will peak the week of Independence Day and lag in the week after. Since July 4th is on a Thursday there are likely a lot of shippers (and carriers) that will be taking Friday the 5th off work and trying to “make up” for the loss of two-days’ worth of shipping by catching up and increasing shipping the following week.

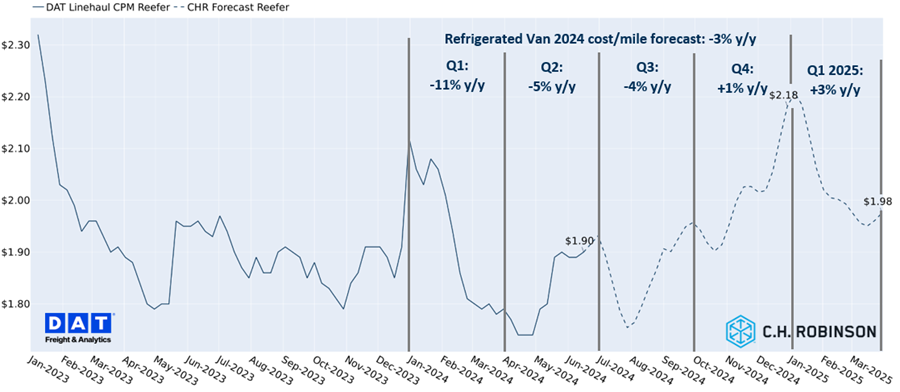

Our 2024 refrigerated linehaul forecast similarly has been cut from last month. The 2024 temperature-controlled forecast is at -3% y/y compared to the previously stated -1%.

Contract truckload environment

Contract trucking strategies and agreements are characterized by freight and lanes with reasonably predictable demand patterns, whereas spot truckload services are typically utilized for lanes with low volume, irregular demand patterns, or poor economic trade corridors. Transportation budgets are shaped by modeling the plannable and unplannable “freight baskets” in a shipper's portfolio, as well as accounting for some level of under-performance in the strategy.

The contractual landscape has remained relatively unchanged in recent months. Q2 is a relatively quiet quarter for RFP activity, but there are still annual RFPs and mini bids that occur at all times of the year. Since most of the bid activity occurs in Q4 and Q1, the second quarter typically sees these routing guides in full operational effect. As discussed in the lead story above, summer disruptions can be impactful to freight. Much of this disruption is heavily impactful in the spot market, but what about the contractual market? It’s understandable that supply and demand dynamics in a particular region could drive spot market costs up due to a hurricane, but if you have freight contracted shouldn’t you be insulated from pricing and truck availability dynamics of the spot market since providers agreed to move your freight in a given lane? Could a hurricane impact capacity in the contractual market? In short, the answer to these questions is ‘yes, but not to the extent of the spot market’.

In our 2022 academic research analysis with MIT’s Center for Transportation and Logistics we uncovered that the volume distribution did change a small amount during the immediate timeframe following hurricanes. This varied based on a few factors, the two largest of which were the overall impact of the storm as well as the volume of freight in the given lane (high or low volume). For example, Hurricane Harvey (2017, Southeast Texas) saw the largest impact compared to the other hurricanes studied. Low volume lanes also saw a larger impact versus high volume lanes with low volume contractual lanes seeing a decrease of volume accepted by the primary provider immediately following Hurricane Harvey. . The percentage of loads accepted by the primary provider decreased by 8 percentage points, and the majority of this freight falling through the routing guide and ultimately ending up in the spot market.

The reason for this decrease in acceptance is not due to providers intentionally rejecting a contractual load in favor of a high-priced spot load, but rather due to disruptions in the supply chain resulting in different positioning of assets against plan. For example, this means that due to the storm in Houston, a carrier may not have been able to take their prior load from Dallas to Houston and thus does not have that truck available for the contractual load out of Houston. As a result, the shipper had to either go deeper into their routing guide (which typically incurs more costs than the primary) or source a truck from the spot market. For the small percentage of freight that did have to fall to and/or through the routing guide, rates increased by about 8%. If you recall the chart in the lead story, spot costs increased by around 30% in the similar situation for the spot market.

While disruptions such as hurricanes can be impactful to contractual freight, the impacts are mostly felt on sparse lanes and during the most severe storms. Performing to the initial plan is something that is advantageous to all parties involved, so having a plan in place for these disruptions will greatly improve your ability to navigate the challenges at hand and minimize interruptions to your supply chain. Having a contingency plan will also assist in staying on track to budget. Talk to your C.H. Robinson account team about how they can help you create a plan to manage through known events such as holidays and unforeseen events such as hurricanes.

Voice of the carrier from C.H. Robinson

C.H. Robinson has two customer communities, shipper customers and carrier customers. What follows are aggregated insights from conversations with carriers of all sizes to offer perspective into their top concerns over the past month.

Market insights

- RFP/bid activity has been decreasing recently, which is seasonally expected, although it remains slightly elevated compared to normal

- The spot market remains challenging to be profitable

- Carrier consensus is that we have hit the bottom of the market with no further down to go

- Carriers are still focusing on and prioritizing relationships and providing good service at fair rates

Equipment

- Used equipment resale value continues to fall. This drop in price negatively impacts some fleets’ ability to keep newer equipment on the road, as they aren’t able to get a large enough return on their used equipment and instead keep their equipment longer.

- Some carriers have reported used trailer costs at nearly half the price they were in 2020

- New equipment costs are dropping as well. Manufacturers are offering free months on leased trailers, for example, based on the lease length.

- Truck parts, tires, oil, and general mechanic labor continue to increase in cost and cut into any margin expansion within carrier operating income

Drivers

- Driver recruiting remains a huge expense, as driver turnover still requires hiring, despite the soft market

- Team drivers: one area of focus for some recruiting strategies is the ability to attract team drivers

A key value proposition of C.H. Robinson to our contract carriers is aggregating lane volume and demand pattern variability from our vast shipper network. This provides our carriers with more predictable volume from C.H. Robinson and as a result are interested in and able to offer consistent capacity and market pricing with high performance. Engage your account teams for more information on how to leverage our scale.

Refrigerated truckload

Produce season continues as growing season is in full swing. While non-produce impacted origins remain soft, California and the Southeast have seen the largest tightening in capacity. We have likely seen the peak of this season at the Mexico-U.S. border. To ensure coverage and the best rates and service, work with your account team to provide visibility to supply chain needs so they can build the proper lead time and flexibility into the loads. For more details on geographies and locations, please reference the map within our last month’s report.

East Coast – The Northeast remains soft, even with shorter than average lead time. Southeast produce season has begun in addition to Miami being the Mother’s Day floral hub that drives the holiday. Capacity is being drawn into these origin points in the Southeast and we expect that to continue through May and into June.

East Coast: The Northeast continues to remain soft, even with shorter than average lead time. Southeast produce season continues to creep north. Southern and Central Florida are largely past peak season, but outbound Northern Florida and through Georgia will continue to see constraints through June.

Central U.S.:Capacity markets through the Mid-North should remain soft through June and into mid-July. Short lead time and same day coverage may provide some difficulties within the central states where there is a lot of protein production, as peak grilling season approaches. We expect the final produce push to occur leading up to the July 4th holiday.

West Coast: Pacific Northwest cherry season has begun, but that has been mostly manageable given the softness leading up to it. Berries and various vegetables are now shipping heavily out of central and northern California. Southern California and Arizona are still experiencing high volumes that likely won’t taper down until July.

Work with your C.H. Robinson team to stay informed on regionalized opportunities and how to best schedule freight to capitalize on the best price and service.

Flatbed truckload

Flatbed is in the second half of its typical peak season but demand constraints continue within the broader market, although there is some variability at the local level. Supply in the marketplace is willing to move to regions and/or shippers where they can offer project or consistent lanes to drivers. These supply and demand trends have led to relatively stable rates this year but still slightly lower overall versus last year.

Safety for drivers while loading/unloading becomes a large priority in the summer with the risk of heat exhaustion/fatigue, especially in warm climates. A few degrees of temperature change increases the risk of mistakes significantly. Shipping facilities that offer drinks, shade, and a place to rest are appreciated by the driver community. As storm season approaches, flatbed demand usually comes in preparation of storms (sandbags, lumber) and then later after initial recovery efforts and assessment of damages. Flatbed demand in storm-affected areas focuses on rebuilding infrastructure (power and utilities) and then a second wave of building construction materials. Partner with C.H. Robinson in the pre-planning and assessment phase of recovery to best service those rushes of demand.

In what has historically been a stable market, the LTL industry has experienced a dramatic year following the closure of Yellow in July 2023. The industry is now starting to fall back into some sense of normalcy, with conditions overall remaining unchanged since last month. Pricing power continues to be indexed more to the carriers than the shippers, but the rate of price increases has normalized.

For the 130 former Yellow terminals yet to be sold or re-leased, there has been no significant change in the last month, as court proceedings surrounding the bankruptcy play out. Those terminals that were purchased by LTL carriers between December and early 2024 are slowly beginning to come back online, although many will remain closed through the second half of 2024 and into 2025. Several of the LTL carriers have announced or posted schedules for re-opening, such as XPO, Estes, Knight-Swift, and SAIA.

LTL demand remains relatively stable, but anticipated increases in tonnage going into the second half of 2024 have not materialized. Tonnage increases will be driven by growth in consumer demand and/or changes in the truckload market, both of which have been delayed compared to expectations earlier this year. As the truckload market shifts over the next 6-12 months, larger LTL shipments that are currently moving in the softer TL market as multi-stop, partial, or even full load truckload shipments will begin to migrate back into the LTL market. The timing of the combination of terminal capacity coming back online, truckload market shifts, and increase in consumer demand is what the industry is watching to determine when and how changes in the LTL market develop.

Both CN and CPKC are back at the bargaining tables with the Teamsters Canadian Rail Conference (TCRC) along with federal mediators. A new strike vote will take place within the union before June 29th. With there still being some uncertainty surrounding the outcome, some steamship lines are diverting sailings away from Vancouver and towards the U.S. west coast ports. The Canadian Industrial Relations Board (CIRB) is in the midst of issuing a decision regarding negotiations, so no strike can take place until a decision is rendered, and a 72-hour notice is provided. Currently, the earliest that a strike could potentially occur would be mid-July or later. This situation remains fluid, so stay in touch with your account team for the most up to date information.

Growth in intermodal has remained strong, primarily driven by international intermodal. Domestic intermodal volume performance is up 1.8% y/y while international intermodal is up 18.5% y/y. Mexico has been the bright spot for intermodal growth in 2024 with double digit increases, keeping up with the last several years of double-digit growth year over year. While the growth in Mexico is impressive it represents a small part of the overall North American Market. The market has ample capacity with an estimated 20-25% of container supply stacked ready to deploy.

Increasing pricing is anticipated for the second half of 2024 and is expected to continue through 2025 in the low single digit range. Railroads have new labor agreements that are driving up labor cost combined in inflationary pressure that will drive these rate increases. The best time to lock in intermodal rates is now before these rates start to increase.

Intermodal service, as measured by train speeds, is tracking just below the 5-year average. BNSF had a mainline Transcon derailment that negatively impacted the May service numbers but the network recovered quickly. Dwell time, another common measure of service, remains under the 5-year average as well.

With strong service and low pricing, contact your C.H. Robinson account team to see how you can best take advantage of intermodal within your portfolio today.

The Federal Maritime Commission (FMC) has recently issued a final rule on detention and demurrage billing practices. Customers that have previously received invoices directly from their dray carriers that they will no longer receive detention and demurrage-related invoices from them after May 28th. Additionally, backup invoices from Steamship lines will not be provided as most have transitioned to statements and public tariffs. This is part of a series of rulemakings by the Commission, as directed in the Ocean Shipping Reform Act of 2022 (OSRA 2022) and underscores the heightened regulatory environment and continued scrutiny of ocean shipping activities in the U.S. foreign commerce. C.H. Robinson has implemented an FMC public detention tariff with competitive rates and terms, which is proactively billed to most shippers. As mentioned in our lead story, the Atlantic hurricane season has begun as of June 1st. Keep in mind that even just the threat of a tropical storm can cause potential disruptions. High winds, heavy rains, and flooding can cause delays at the ports, which can cause further downstream issues.

- Southern Florida:A tropical disturbance brought a flash flood emergency to much of southern Florida as parts of Miami and Fort Lauderdale were completely flooded by over 20 inches of rain as of June 13th. Certain areas along the Florida East Coast Railway corridor as well as I-95 were shut down due to flooding. As hurricane season approaches, this is something to keep an eye on in this and other geographies.

- Charleston:The Port of Charleston has experienced issues that have affected its ability to work vessels efficiently. These issues are delaying vessels and will affect schedules in the near-term.

- There is an ongoing toe wall project that has closed 1 of the 3 large capacity vessel berths

- A hazardous spill caused one of the large vessel berths to be inoperable for 3 days while the spill was cleaned

- The SC Ports had a system outage that lasted almost 48 hours. All critical systems have been restored at this time.

- Norfolk: The local market is still experiencing significant congestion and re-routing delays increase caused by diversions from the Baltimore bridge incident. Federal data is showing that traffic crashes rose 29% on alternative routes in the weeks following the Key Bridge collapse and the same data shows that it now takes between two and four times longer for drivers to travel those alternative routes. These issues are expected to quell once freight is able to get effectively rerouted back through Baltimore as initially desired.

- Appalachian Regional Port (ARP): Our motor carriers have been getting more requests for lanes picking up from the ARP as an alternative to the Atlanta rails, but this requires a significant increase in base pricing since there are not a lot of Atlanta based carriers in the ARP market.

- NY/NJ:APM and PNCT terminals are behind the influx of containers diverted from Baltimore (carriers expect the PNCT terminal to be congested all week). Maher, GCT Bayonne and GCT New York terminals are operating as normal. Smaller carriers will be backed up as equipment may be in deficit, please work with Inland Product for any capacity needs.

- Baltimore:Crews have completed the clean-up work needed and fully opened the primary 50ft deep, 700ft wide Fort McHenry channel. The re-integration of the Baltimore port back into supply chains may vary in time by providers and shippers, so a phased in return to normalcy is expected.

- Cincinnati:Volumes are flat over the previous quarter and previous year. Pool chassis are plentiful in the market. Rail dwells continue to be an issue despite the market being soft, NS Gest especially bad with 2-3 hour turn times during normal lift hours some days.

- Pittsburgh:Carriers are reporting that volumes are up. Short Lead times are hard to fulfill due to the increased volumes. Container equipment remains scarce, and chassis are not being released for exports. Chassis availability is extremely limited for imports resulting in storage fees due to multiple trains arriving at once. Please reach out to Inland Product if you have consistent volume and need solutions.

- Louisville:Import operations are running slow, taking longer than normal to ground and become available at NS Appliance Park causing delays with export equipment availability.

- Memphis/Nashville:ONE line has changed its preferred choice of chassis in Memphis and Nashville from MPOC to Flexi-Van chassis effective June 1st, 2024. We will see this primarily impact operations out of the UP Marion, AR rail, which is a wheeled facility.

- Oakland:Reporting 5 vessels at berth, 2 vessels at anchorage with 8 more vessels to arrive in the next 48 hours. SSA Terminal is a challenge, carriers have hard time securing appointments and containers are sitting longer in closed areas which may cause delays.

- Los Angeles-Long Beach: Rail container dwell of eastbound IPI freight is on the rise and being closely monitored as more IPI inbound cargo is arriving at these terminals. Current analysis shows that we are on the edge of rail car availability and congestion could appear through May should import bookings moving Eastbound via LA/LB continue to rise. Due to lack of advanced notice to the terminals and railroads about bookings at origin requiring IPI rail capacity, the terminals are preparing space and moving containers to accommodate what they expect to be increased demand but keeping dwell of IPI containers within 4-5 days is key.

- Port of Houston: Experienced a major storm the first week in June that impacted power and mobility around the city. While the infrastructure is now repaired, some compounded delays persist.

For a full market report on global forwarding, visit the C.H. Robinson Global Freight Market Insights.

The big news this month in Mexico was the presidential elections that just happened on June 2. Nearshoring continues to gain momentum following the election of Claudia Sheinbaum as Mexico's next president. Sheinbaum, a former Mexico City mayor and physicist, brings a background in sustainability and renewable energy, potentially beneficial for Mexico's economic strategies. She aims to invest in improvements to regional transportation and support nearshoring activities. The Morena Party, to which Sheinbaum belongs, secured significant wins in Congress, allowing potential for key and (potentially) controversial reforms.

Despite Mexico's strategic location and proximity to the U.S. market, the country faces infrastructure challenges (some of which we have discussed here in the past), including inadequate water and energy supplies and a need for better transportation networks. Recent construction of industrial parks in northern Mexico indicates a shift in production, but future investments are crucial to establish new manufacturing hubs. Experts believe Sheinbaum's administration may focus on practical solutions rather than politics, which would benefit nearshoring. This includes building infrastructure, allowing private investment in energy, improving education, and promoting the rule of law. As it commonly happens in an election year, investors wait out to see the outcomes before making several investment decisions. With the elections over, the expectation is that investments will start to improve.

In previous Robinson Reports in April and May, we discussed the impacts of the strong Mexican peso on carriers’ finances and trucking rates since an important amount of cross-border carriers invoice in U.S. Dollars. During this year, the Mexican peso kept strengthening over the U.S. Dollar reaching the 16 pesos per dollar barrier until the day after the election on June 3rd when the peso started to fell compared to the U.S. dollar, reaching the 18 pesos per dollar level. The Ministry of Finance has issued a statement indicating that the new government expects to continue with a policy similar to the current government’s, so it’s difficult to know if the peso will keep falling or begin to recover in the near future. This indicator is taken into consideration by carriers as they issue rates, so if the peso is stronger carriers could be inclined to increase rates.

The dollar volume of exports from Mexico to the U.S. keeps reaching record levels. The new monthly high was achieved this April when exports reached $43.6 billion dollars. This represents a 13% increase y/y when compared to April of 2023. Mexico maintains the title of the top trading partner to the U.S. representing 15.6% of the country’s imports in April. In the first four months of 2024, Mexican exports have grown a combined 6.2% compared to the same months of last year.

Tariffs on Chinese electric automobiles, medical devices, healthcare related goods and other type of goods are anticipated to significantly increase Mexican exports to the U.S. In Q1 2024, Mexican exports to the U.S. increased 3.8%, closely tied to the spending of goods by U.S. consumers. Medical device exports from Mexico to the U.S. grew 25% in 2023 according to data from the U.S. Department of Commerce. The newly imposed tariffs that the U.S. imposed on these Chinese goods provides potential for nearshoring to persist and for Mexico-to-U.S. transportation volumes to continue to increase as well.

One of the most important outcomes of the recent presidential election in Mexico and the pending election in the U.S. is the upcoming revision of USMCA that will happen in 2026. For this review the weight of the automotive sector is undeniable. The rules of origin in the automotive sector under the USMCA have driven nearshoring in Mexico. The requirement for 75% regional content value has significantly boosted investments in the country. Mexico's automotive sector is crucial, accounting for 32% of the nation's exports and a trade surplus of over $107 billion. Mexico is the world's largest exporter of trucks, fourth in heavy vehicles, and fifth in light vehicles, with 90% of U.S. vehicles dependent on Mexican parts. While a full renegotiation of the USMCA is unlikely, specific rule adjustments are possible, depending on the outcomes of ongoing disputes and the political landscape post-2024 elections.

Talk to your C.H. Robinson representative and leverage our expertise built on 100 years of experience doing cross-border business.

Cross-border: U.S.—Canada

The theme for Canada cross-border has been the threat of strikes in two key areas: rail and customs. One situation has been resolved, while another still looms. We recommend staying in contact with your C.H. Robinson account team as the summer progresses for the latest developments and solutions.

The potential rail strike for Canadian Pacific Kansas City (CPKC) and Canadian National (CN) railways has been aborted for June, but still has potential to happen in July. It is estimated that nearly half of Canada’s export volume is transported by rail. The strike action has been delayed as the Labour Minister determined that if a strike were to happen, it would pose a risk to Canadian’s health and safety. Some shippers are taking action to boost inventories now to avoid surges in prices and delays in transit if the rail lines strike. This is affecting buying decisions and prices on Intra-Canada long-hauls, and it will likely have a greater impact as we move closer to July.

A potential CBSA (Canada Border Services Agency) Union strike was averted, as the union and CBSA announced a tentative contract agreement. Had a contractual deal not been reached, major border disruptions were likely to occur. Trade between Canada and the USA would have continued since these customs roles are deemed essential. Approximately 90% of front-line CBSA border officers are designated essential, so Canadian border crossings would have remained open for all traffic. In the event of a strike, despite there being customs agents present and working at US/Canada crossings, the likelihood of major delays was increased as agents would not have had a timeframe to process a clearance, as long as they were working—essentially this means that they could be on the job, but could slow down the process to the point where it would severely choke crossing points and impact commercial traffic and personal travel, highlighting the importance and criticality of their roles and work.

Regarding current market conditions (strikes aside), shipments originating in Canada heading to USA (southbound) are highly coveted. The truckload market is still over capacity and running at approximately 8-10 trucks for every load. Conversely, shipments heading to Canada (northbound) have had some tightening of the market especially to the Western Provinces MB, SK, AB, and BC. Constraints have been from southern, produce regions FL, GA, TX, CA. Overall, the market is still loose, and rates are depressed compared to the previous two years despite this seasonal tightening.

President Biden signed the FAA reauthorization bill last month. While this bill addressed safety and staffing of the air transportation system as a whole (among other things), it will not impact airfreight transportation much at all. The federal freight policy calendar will now pause for the November 2024 election before preparing for a robust debate throughout 2025 around priorities for the next highway/infrastructure bill. The Infrastructure, Investment and Jobs Act will expire in September of 2026.

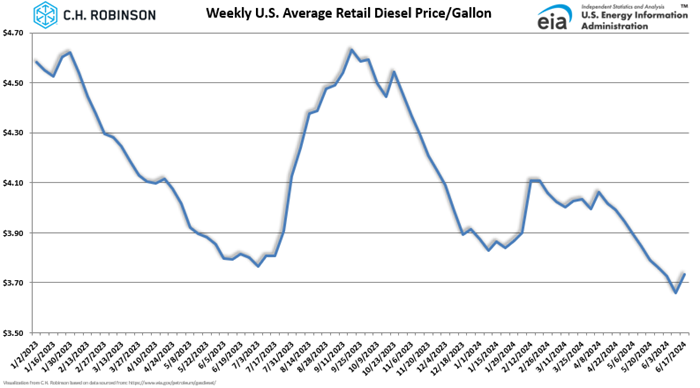

Retail diesel's national USA average price per gallon of $3.82 in May is down from $4.00 in April, and still lower than the $3.92 average from May 2023. As depicted in the visual below, created based on the data provided by the EIA, you can see that fuel has been decreasing in the back half of April and into May. Diesel pricing continues to decrease, most recently getting down to levels not seen in 2 and a half years.

Recent market updates

- Robinson Roundup: March 20, 2025

- Freight Market Update: March 6, 2025

- Robinson Roundup: February 20, 2025

- Freight Market Update: February 2025