What’s Happening in the Transatlantic’s Ocean Shipping Lane | Transportfolio

Certain trends in capacity, rates, and tariff activity have conspired to create an especially dynamic holiday season for ocean shipping in the Transatlantic lane. It’s never too late to understand the forces at work that have created the current market, or to explore ideas that can help insulate your business in periods of market volatility—or anytime.

Understanding the Transatlantic’s Ocean Shipping Lane

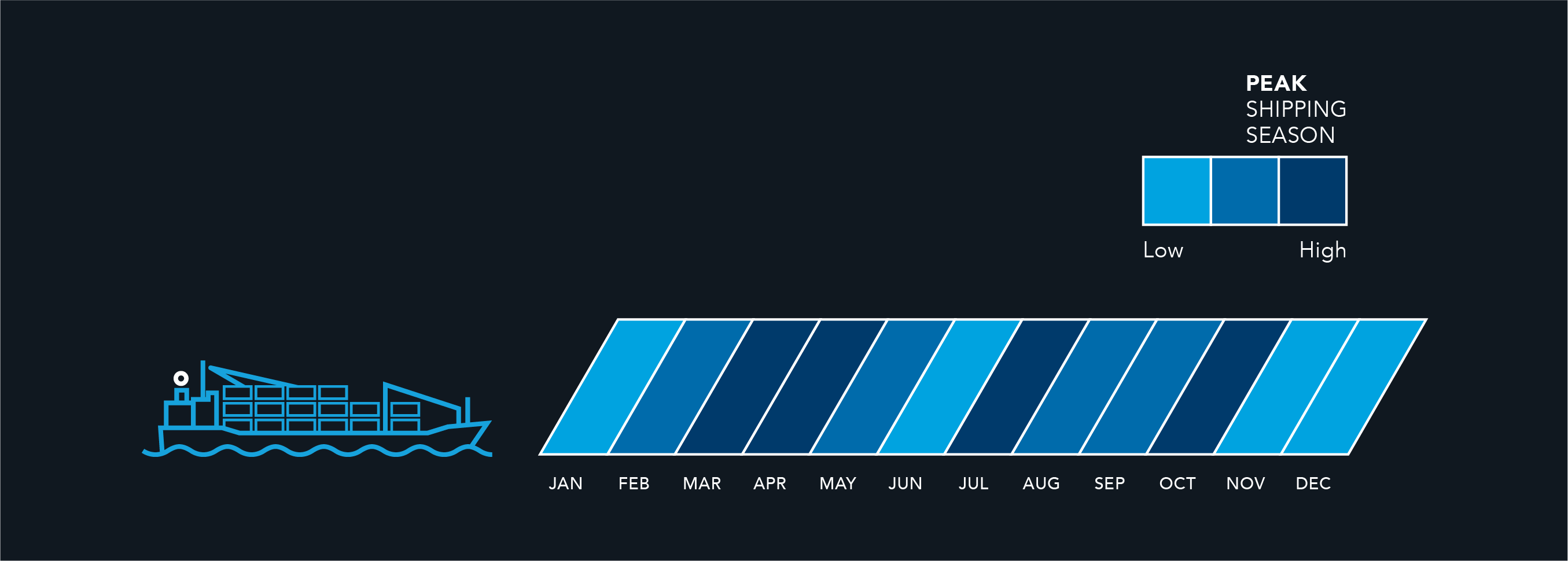

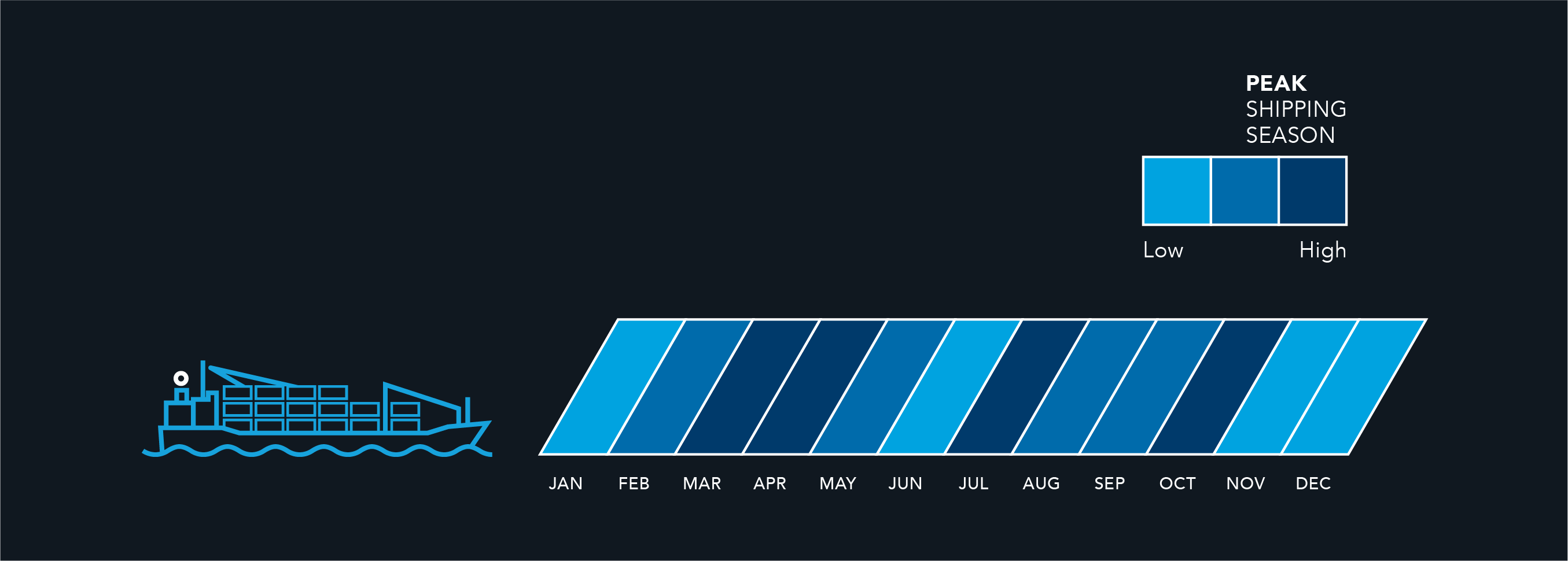

In regular years, carriers try to leverage peak shipping periods as much as they can. Typically, they will increase rates as high as they can to make up for their losses when shipping slows. And in those slower shipping periods, ocean carriers will often remove capacity to stabilize supply and demand and preserve rate levels.

This year as in the past, carriers used this strategy. In May, Hyundai Merchant Marine announced plans to end two services on the Transatlantic and no longer service this trade until further notice. And, two months after launching with five 4,200 to 5,000 TEU ships, the Ocean Alliance of COSCO Shipping, CMA CGM, Evergreen and OOCL canceled the TAT4/TAX loop.

Unfortunately, removing capacity alone doesn’t have much impact on carriers’ bottom lines. Bunker prices, which represent as much as 50% to 60% of a ship’s total operating costs, have a greater impact on carrier profitability. Fuel prices have increased substantially this year, and rates have gone up as a result.

Unexpected disruptions have also impacted this holiday season’s ocean capacity in the Transatlantic lane. At Felixstowe, one of the UK’s main ports, issues arose after a new terminal operating system was installed in June, and several weeks of delays in both ship and train loadings followed. And COSCO Shipping Lines confirmed in late July that it had suffered a cyber attack, which impacted its internet connection within its offices in America.

We are often asked how much the U.S./EU tariff discussions are impacting rates and capacity. It’s still too soon to know for sure. U.S. steel and aluminum tariffs and the EU’s retaliatory tariffs didn’t go into effect until June. We will have to wait and see as events unfold.

Choosing the Right Transatlantic Ocean Shipping Strategy

In the meantime, what can you do if you ship in the Transatlantic lane and are dealing with capacity shortages and rate spikes? Three strategies can lead to better outcomes for your freight planning, even in peak holiday shipping periods.

- Forecast and book your space earlier. Holding plans close to your vest does not work in your favor during peak shipping seasons, since you are competing with other shippers for the same space allotments. The key is to share your forecasts with your service providers and give them as much lead time as you can. Finding available space is very challenging with less than two weeks of lead time.

- Work with a provider who offers multiple capacity options. The more options your service provider can give you, the better. In our business, we negotiate across all the carrier alliances to identify more routings and more space for you.

- Consolidate freight. We can help you consolidate your shipments with compatible freight from other shippers into a single containers to make better use of the available space—and you pay only for the space you use. You get specific transit times and regular sailing schedules for better reliability and flexibility for meeting unexpected demands. And because we pick up the product, bring it to a warehouse, and load it ourselves, we can build containers to minimize damage.

Final Thoughts

Peak seasons can make or break supply chains. If you need help mitigating the risk of volatile markets, call our logistics experts. We can walk you through the options and choose the one that’s right for your business.

[1] https://www.morethanshipping.com/fuel-costs-ocean-shipping/ Elizabeth Stratiotis, “Fuel Costs in Ocean Shipping,” morethanshipping.com, January 22, 2018.