Trade regulations are always changing, with daily updates to old rules and the addition of new ones. When I’m helping companies with issues related to U.S. Customs and Border Protection (CBP), people are often curious about what causes fines and penalties and what they can do to prevent them. Here are the answers to the most asked questions.

- What are the most common customs violations that result in fines?

While there are no published statistics on this, I would say that CBP is most likely to scrutinize:

- Free Trade Agreements. Wrong or inaccurate interpretation of special trade programs. Does the product really qualify? What means, processes, and justification did the importer use to determine that the goods qualified? Do you have the proper documents on record at time of import to support this claim?

- Valuation. There are five basis of appraisement. The most common is transactional value, which is generally completed through an arm’s length transaction of two non-related parties. Transactional value is the price actually paid or payable, plus certain statutory additions including assists, royalty, and licensing agreements, and selling commissions, packaging, and proceeds from subsequent sales. In regards specifically to assists, some companies don’t realize that if an assist (tooling, dies, molds, engineering/design work, etc.) are provided free or at a reduced rate and are used in the production of goods that are subsequently imported into the United States, the value of the assist, plus the transportation to get it to production, must be added to the total entered value.

- Classification. Inaccurate product classification can lead to disastrous outcomes regarding import compliance. The incorrect use of special trade program terms is just one example. Special trade program eligibility is often predicated on the Harmonized Tariff Schedule (HTS) being applied to the goods.

- Expect Antidumping/Countervailing Duties (ADD/CVD) to join the list in coming years. CBP leaders are already working with industry and Congress to increase communication around ADD/CVD enforcement. Their goal is to identify mechanisms that may improve outcomes and prevent evasion of these duties.

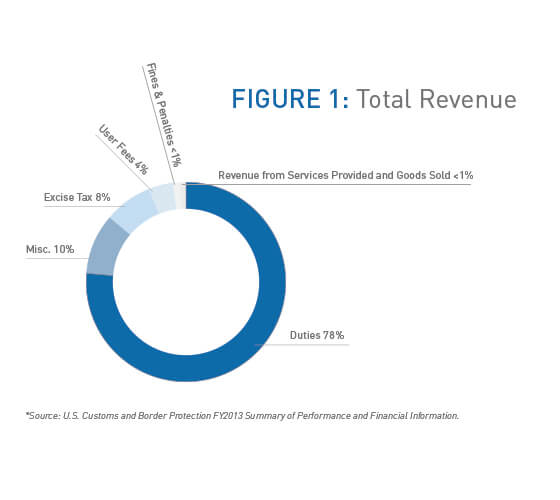

- How much of CBP’s total revenue can be attributed to fines and penalties?

- How long does Customs hold freight if there are compliance issues?

Depending upon the type of examination that occurs, freight can be detained for as little as a single day up to several weeks. Or, potentially, the goods may not be allowed entry at all!

- What are the most important things that companies can do to prevent fines?

The most important things are to have knowledgeable, trained internal staff, active senior leadership buy in and support, and a robust compliance program that includes a manual. Training, training, training is an absolute must for all areas of the organization, since import compliance reaches far beyond logistics, supply chain, transportation, and similar functions.

- What are the most asked questions your customers have about customs compliance?

“Doesn’t my broker take care of that for me?” “Do I really need an import compliance program?” “Do I need to have someone dedicated to import compliance?” “But my stuff is duty free, so why does the government care?”

If you have more questions about CBP practices, the CBP website is very comprehensive and can be quite helpful. You might also look into one of our full-day seminars on imports and exports.