What Does Your Global Supply Chain Look Like From 30,000 Feet? Map It

Start wide, go narrow. It’s a good rule for a new outsourcing provider to follow, just as it is for real life. For instance, say I met a man from India at a conference in Europe, and he asked where I was from. I wouldn’t say “Minneapolis” right away. I would say the United States, then Minnesota; if he knew where the state was, I might add the city, Minneapolis. With each clarification, he can better envision exactly where I live, in relationship to the country overall.

When an outsourcing provider looks at your supply chain, they need to do the same thing. They need to grasp the geography of where you’re coming from, with all the peaks and valleys. They need to understand the big picture. Then, the provider can gradually add details until they have a complete picture of your supply chain and where you might go from there.

As an outsource provider, we can’t fix what we don’t understand. And because each solution must be as unique as the company it belongs to, we start to understand by mapping the entire supply chain. As part of our discovery process, we look at our clients’ supply chains through the lens of the Supply Chain Operations Reference Model (SCOR). It says there are five functions of a supply chain:

- Plan

- Source

- Make

- Deliver

- Return

Each of these steps could be considered the moving parts of the customer’s supply chain, and each has its associated processes and steps. The question is, how smoothly do the moving parts work together, and what is the relationship from one part to the next?

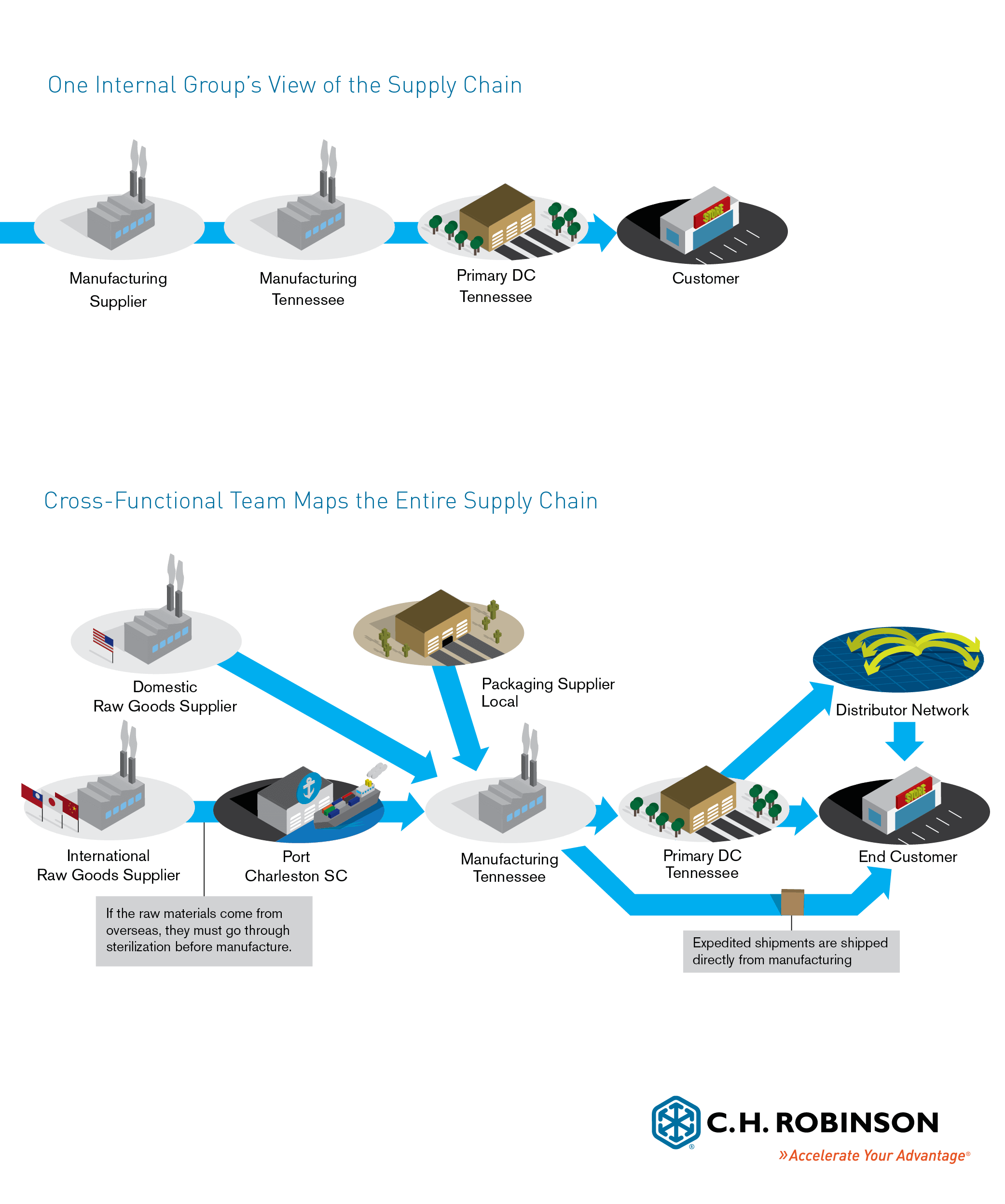

Getting to that information requires a serious review of the entire enterprise—one that includes a cross functional team from all groups that make up the complete supply chain. There’s a simple reason for this: although each person may have deep knowledge of how their part of the supply chain works, even the most knowledgeable expert will not know every step in the process. In many companies, people from transportation, purchasing, manufacturing, finance, and other areas works in relative isolation. In essence, each group does what they do, but doesn’t exactly know what the other groups do. Bringing everyone together in one room often reveals surprises that can add steps to the process—sometimes, those steps can be eliminated.

Mapping a company’s supply chain requires information about each of the moving parts:

- How are suppliers segmented (e.g., international goods vs. domestic, raw goods vs. finished goods)?

- Where are goods manufactured and how are they distributed?

- Who is in control of the freight at each point?

- Which modes are utilized?

- Where are the packing houses, distribution centers (DCs), warehouses, and other facilities located?

- In the DC, does any repackaging occur?

- What does the customer segmentation look like? (e.g., direct to customer vs. distribution network)

- Do manufactured goods need to be processed by a value-add supplier before end customer delivery?

Once the map is created, we identify opportunities for process improvements. Any solution we help create must align with a customer’s strategy and provide a potential competitive advantage. In an outsourcing engagement, it’s critical that we know every potential move in order to identify and mitigate risks. Changes made to one part of a supply chain can have unintended consequence upstream or downstream.

Mapping supply chains often reveals issues that affect the total landed cost of a product, although it may not be immediately apparent without thorough questioning. For instance, a manager who works exclusively with suppliers might explain their supplier network to the provider, but might not mention what the Incoterms 2013® are with their vendors. Incoterms 2013® are crucially important to a complete understanding of the supply chain. These predefined commercial terms, published by the International Chamber of Commerce, clearly communicate the tasks, costs, and risks associated with the transportation and delivery of goods. They are regularly incorporated into sales contracts worldwide to describe who bears the risk in the transaction, and when the risk transfers from buyer to seller. Knowing which Incoterms 2013® a company uses absolutely makes a difference in determining the total landed cost of a product, but it’s not always included in the wheelhouse of procurement managers. Other parties in the supply chain, such as transportation managers, may consider it more essential to mention, since it affects their day-to-day work.

In the end, a supply chain map is just a pretty picture. The true benefit is the knowledge gained during the process of creation. The next step is to evaluate. Maybe the organization is sending a product to an outside firm to be painted, then having it returned to their own warehouse; perhaps they had never considered that the resulting costs could be eliminated if they shipped direct from the paint facility to the end customer. Maybe a company doesn’t realize how much money they leave on the table when their vendors control inbound freight and charge extra for transportation. Companies of any size can benefit from supply chain mapping, since size and complexity are not mutually exclusive.

A global supply chain map offers a great deal of value. As we understand how the supply chain works, we can deliver more thorough solutions, and the company more clearly sees the opportunities ahead. Companies are often amazed when they first see their entire supply chain laid out on a single piece of paper, often saying, “We’ve never looked at our supply chain like this.” Mapping is the very first step in learning what is working smoothly and shining a light on all the missed opportunities and risks the company didn’t even know they had.

What does your global supply chain map look like? We’d like to hear how you gain perspective on the subject.